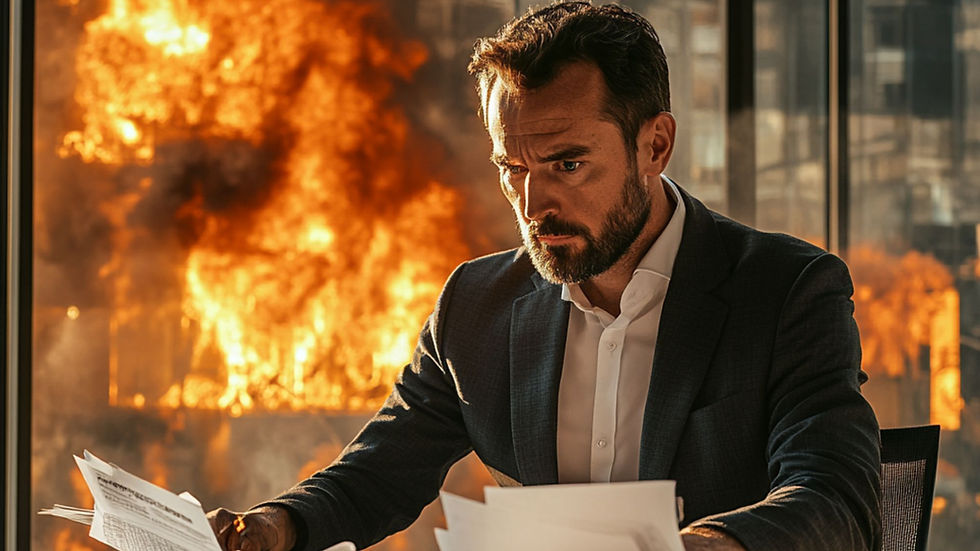

You, as a savvy business owner, know that protecting your commercial property is crucial to the success and security of your enterprise. One essential aspect of this protection is having fire insurance in place. However, navigating the claims process can be intricate, and there are common pitfalls you must avoid to ensure a smooth and successful claim experience.

1. Underestimating the Value of Your Property

When it comes to filing a fire insurance claim for your commercial property, accurately valuing your assets is paramount. Many business owners make the mistake of underestimating the value of their property, leading to inadequate coverage in case of a fire. To avoid this, conduct regular valuations and ensure your policy reflects the true worth of your property.

2. Neglecting Documentation and Records

Thorough documentation is your best ally when making a fire insurance claim. Failing to keep detailed records of your property, inventory, and maintenance could result in delays or denials during the claims process. Make it a priority to maintain up-to-date records to substantiate your claim effectively.

3. Inadequate Coverage and Policy Review

Don't fall into the trap of insufficient coverage! Reviewing your fire insurance policy regularly is essential to ensure you have adequate coverage for your commercial property. Changes in property value or new acquisitions should prompt a review to prevent being underinsured in the event of a fire.

4. Delayed Notification and Reporting

In the aftermath of a fire incident, time is of the essence. Promptly notifying your insurance provider about the fire and initiating the claims process is crucial. Delays in reporting can complicate the assessment and settlement of your claim. Be proactive and swift in your communication.

5. Disregarding Professional Assistance

Navigating the complexities of a commercial property fire insurance claim can be overwhelming. Seeking professional assistance from public adjusters or legal experts can significantly aid in maximizing your claim settlement. Don't hesitate to leverage their expertise to ensure a fair and efficient claims process.

In conclusion, when dealing with commercial property fire insurance claims, vigilance and attention to detail are your best allies. By avoiding these common mistakes and staying proactive throughout the claims process, you can safeguard your business and ensure a seamless recovery in the event of a fire incident.

Remember, protecting your commercial property isn't just about having insurance – it's about being prepared and informed to handle unexpected situations with confidence. Stay vigilant, document diligently, and review your policy regularly to mitigate risks and ensure the protection of your valuable assets.

In the dynamic landscape of business ownership, foresight and preparation are your greatest assets. By heeding this guide and steering clear of common mistakes in your commercial property fire insurance claims, you are empowering your business with the resilience and protection it deserves.

コメント